Mon, 14 Mar 2005

Finished 1120S

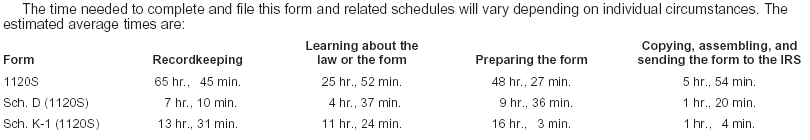

I finally finished the federal corporate taxes for Postica, the 1120S and

related forms and schedules. It took a long time, but less than the 184 hours

that the IRS estimates. Seriously, the IRS estimates it will take more than

one man-month to file just the 1120S and K-1.

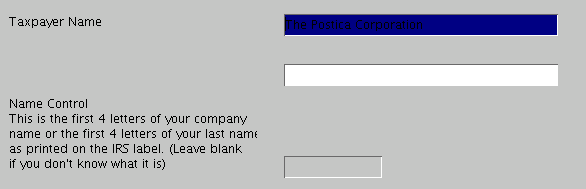

I filled out the return by hand first, and then copied the information into Taxsoftware.com's forms. Their software is

very minimalist, especially compared to TaxAct

which I've been using for years to do my taxes, first their Windows version,

now the online version. The Taxsoftware software is a bunch of Java applet

forms which, once completed, are used to generate a PDF form of the tax forms.

Unfortunately, I couldn't figure out how to fix the background color of

selected fields so I had to fill out each field blind, then remove focus to

verify that I had entered the correct value. I tried changing a bunch of X

resources to get the color to change, but was unsuccessful.

I'm almost done with the California return, 100S, too. Luckily, it's mostly copying data from the federal return. I do have to keep a separate depreciation schedule though since California doesn't allow the 50% bonus depreciation.