Wed, 24 Aug 2011

Self-Employment Tax Thoughts

I filed my taxes Tuesday night. It wasn't quite the relief it usually is though. This was the first year in which my income was mostly 1099 income. That means that self-employment tax reared its big ugly head. I knew it was coming, but when it looks you in the eyes, it's still frightening. After writing off my business expenses, my total taxes were actually about $3,000 less than the rough estimate I made last year when filling out my 1040-ES. Nonetheless, I still owed the feds over $10,000 of the almost $19,000 total tax liability.

What makes the number so shocking is when you compare it to a return for which all of the income is W-2. With W-2 income, the section of the 1040 labeled Other Taxes is generally blank. As an employee, you pay 7.65% of your wages for Social Security and Medicare insurance, but this amount doesn't show up on your tax return. When your self-employed, the 15.3% tax on your net business profit shows up under Other Taxes, increasing the bottom line (line 62, that is) substantially.

One nice thing about being self-employed is being able to write off business expenses that employees typically can't. This year, I expensed gas and other automotive expenses, internet access, office supplies, part of my rent and utilities, and depreciated computer equipment and part of my car. Working from home, I don't have too many expenses so I was only able to reduce my gross income by about 6% in calculating my net profit. I was also able to write off my health insurance premiums, but that only reduces my adjusted gross income rather than business income, and thus doesn't reduce the SE tax. So I was left with a large amount of self-employment tax to pay.

In 2005, I'm going to set up and contribute to a SEP-IRA and a Health Saving Account which will reduce my income tax, but not my SE tax unfortunately. To reduce my SE tax, I may form an S Corporation. Paying myself half the corporate income in salary, which is subject to SE tax, and rest as a distribution, which is not, would probably be fair and would reduce my SE tax by quite a bit.

business » taxes | Permanent Link

Fri, 24 Nov 2006

Creative Talent Tax Exemption

I had to pay business tax to the city of Los Angeles last month since I receive 1099 income. The city took $600 from me, but it turns out that "creative artists" who earn up to $300,000 are exempt from the business tax thanks to the lobbying of the Screen Writers Guild. I should move to New Hampshire.

business » taxes | Permanent Link

Thu, 18 Aug 2005

Opt Out of Social Security

Join a church. Separate from state.

While doing my taxes this year, I discovered IRS Form 4029 which allows an individual to opt out of social security and medicare. To do so, you must be conscientiously opposed to accepting benefits of any private or public insurance that makes payments in the event of death, disability, old age, or retirement; or makes payments for the cost of medical care; or provides services for medical care. While I am conscientiously opposed to public insurance, I have no objections to private insurance. Of course, there are a couple other stipulations. You must also join a collectivist organization with a belief in the supernatural which has been in existance since at least 1950.

Individuals who wish to be self-sufficient or participate in private insurance programs rather than be part of the state's welfare system are unable to do so. I find this to be egregious. I have contact my elected representatives in Congress to let them know how I feel, but I'm not expecting much considering that both Senators Boxer and Feinstein have petitions on their home pages to preserve social security as is.

Here's the short note I sent to Congressman Sherman and the Senators, and the non-responsive form letter response from Ms. Boxer.

Congressman Sherman, As President Bush and Congress are currently working on the reform of Social Security, I would like to propose that one of the reforms include the ability of citizens to opt out of participation in the Social Security and Medicare insurance programs. Being a responsible individual, I plan to save enough money during my productive years to fund my retirement until death. I am conscientiously opposed to accepting welfare from the state and would be happy to waive all rights to Social Security benefits in return for not being required to contribute to the program. Such an option is available to members of certain religious organizations, and I would appreciate your support in ending such unconstitutional discrimination. Thank you for you time and I would be delighted to hear your thoughts on the issue. Sincerely, Christian Warden

Date: Fri, 4 Mar 2005 09:21:31 -0500 From: senator@boxer.senate.gov To: cwarden@xerus.org Subject: Responding to your message March 4, 2005 Mr. Christian Warden 18531 Prairie Street, Apartment 214 Northridge, California 91324-3156 Dear Mr. Warden: Thank you for writing to express your concerns about President Bush's plan to partially privatize Social Security. I appreciate hearing from you. Social Security is a crucial insurance program and an indispensable safety net for our people. It has been enormously successful. Before Social Security, over half of all seniors were poor. Today, 10 percent live in poverty. That is still too many, and we want to take care of that. What we do not want to do is go back to the days when 50 percent of our seniors were living in poverty. Under the President's plan, Social Security benefits would be cut by 45 percent. The average yearly payment would be only $5,700, which is 35 percent below the poverty line. That would be a tragic reversal of fortune for our people. Certainly we know that Social Security needs periodic adjustments. However, President Bush is misleading the American people by calling this a "crisis." According to the Social Security Trustees, there is enough money to pay full benefits until 2042. And according to the Congressional Budget Office, there is enough money to pay full benefits until 2052. Now more than ever -- as we are faced with an aging population, the imminent retirement of the baby boom generation, the costs of the war on terrorism, 40 million Americans without healthcare, and a ballooning budget deficit of well over $400 billion -- we cannot afford to divert needed funds away from an already stressed Social Security system. ^L This is too much of a risk to take with funds that so many workers are counting on for their retirement. Privatization would also impact people with disabilities, survivors of deceased workers, and 3 million children who depend on Social Security benefits. I feel strongly that we should not weaken Social Security or compromise its financial condition. Rest assured, I am committed to preserving the integrity of Social Security for generations to come. And it is not difficult to solve this challenge, just as we did in 1983. Again, thank you for taking the time to voice your concerns. Please continue to keep me informed about the issues that matter to you. Sincerely, Barbara Boxer United States Senator

Disclaimer: As a child, my mother received welfare. And while it allowed her to spend time raising me, given the choice, I would not want to be a burden on my neighbors.

business » taxes | Permanent Link

Fri, 15 Apr 2005

Taxes Kill Productivity

Cantillon's Paradise points to an AP story which says that Americans spend 6.6 billion hours on their taxes. It's rather ridiculous the lengths a citizen must go to in order to comply with the law. Luckily, our civil servants are working to resolve this issue.

Sensitive to the demands that tax laws put on weary taxpayers, the IRS has seven people working full time to reduce the anguish for filers. The IRS Office of Taxpayer Burden Reduction looks for requirements that can be streamlined, reduced or eliminated under the law.

Of course, there's only so much they can do considering the amount of tax law that are in charge of enforcing. Congress is responsible for the mess.

I've probably spent at least 60 hours on taxes so far this year, mostly reading IRS publications, including best sellers Business Expenses, Business Use of Your Home, and the much referenced tome, How to Depreciate Property.

My wife recently decided to change her major to accounting. I think I have the perfect internship for her.

business » taxes | Permanent Link

Mon, 21 Mar 2005

Bow and Arrow Taxes

All of the archers out there will be happy to hear that the Arrow Tax has been repealed. Alas, the Bow Tax still applies.

Bows

The 11% tax on bows will apply to bows having a peak draw weight of 30 pounds or more. This replaces the current law which applies to bows having a peak draw weight of 10 pounds or more. Broadheads suitable for use with certain arrows will be taxed as a part and accessory at the 11% bow tax rate. The effective date for both provisions is for articles sold after November 21, 2004.

Repeal of Arrow Tax

The tax on arrows that was in effect for arrows sold after November 21, 2004, and before December 23, 2004, has been repealed. The rules used prior to November 22, 2004, for arrow components still apply for the 4th quarter of 2004. Any tax that was imposed by the manufacturer, producer, or importer on arrows after November 21, 2004, and before December 23, 2004, may have to be refunded to the purchaser. See Changes Effective for the Second Quarter of 2005 for details on the tax on arrow shafts effective after March 31, 2005.

How much are we paying the members of Congress to make these laws? (Hint: It's less than $155,101)

Update: Unfortunately, those arrows aren't really tax free. Beginning March 31, there will be a tax on the arrow shaft.

business » taxes | Permanent Link

Mon, 14 Mar 2005

Finished 1120S

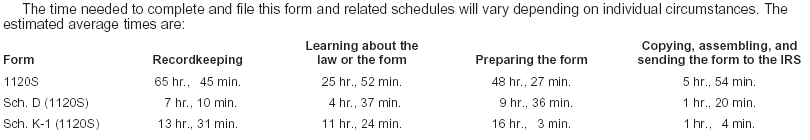

I finally finished the federal corporate taxes for Postica, the 1120S and

related forms and schedules. It took a long time, but less than the 184 hours

that the IRS estimates. Seriously, the IRS estimates it will take more than

one man-month to file just the 1120S and K-1.

I filled out the return by hand first, and then copied the information into Taxsoftware.com's forms. Their software is

very minimalist, especially compared to TaxAct

which I've been using for years to do my taxes, first their Windows version,

now the online version. The Taxsoftware software is a bunch of Java applet

forms which, once completed, are used to generate a PDF form of the tax forms.

Unfortunately, I couldn't figure out how to fix the background color of

selected fields so I had to fill out each field blind, then remove focus to

verify that I had entered the correct value. I tried changing a bunch of X

resources to get the color to change, but was unsuccessful.

I'm almost done with the California return, 100S, too. Luckily, it's mostly copying data from the federal return. I do have to keep a separate depreciation schedule though since California doesn't allow the 50% bonus depreciation.